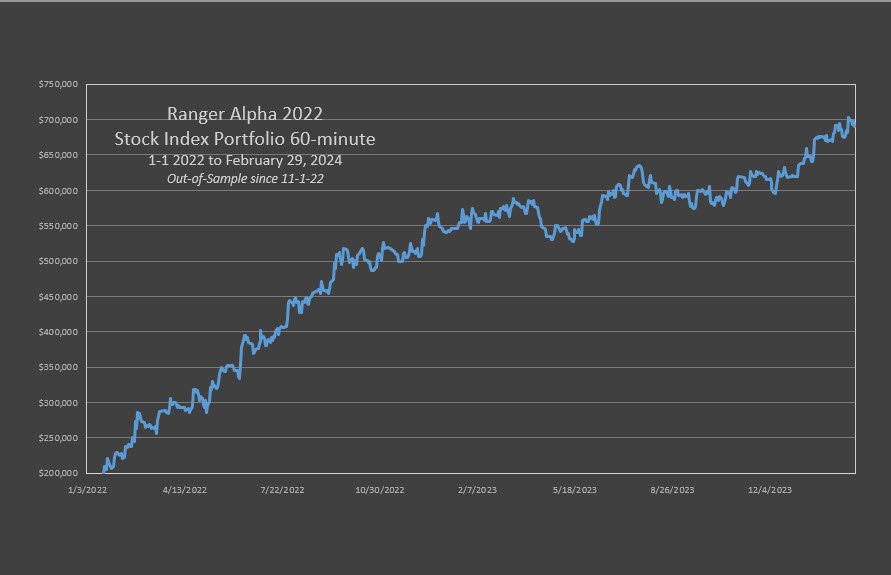

The Stock Index Portfolio

This Ranger Alpha 2022 Stock Index Portfolio consists of Trios for the eMini, NASDAQ and Dow futures.

Performance for each Trio is available on the sections in this page.

The performance here is produced by strategy signals which are all a result of Walk-Forward Analysis.

This is a very important distinction. Walk-forward Analysis (WFA) is widely considered to be the gold-standard in strategy development. Our experience has been that strategies developed with WFA are far more robust than strategies developed with less advanced processes. More detail on WFA can be found in Bob Pardo's classic book The Evaluation and Optimization of Trading Strategies published by J. Wiley.

Each RA22 Stock Index Portfolio is the result of a complex process of picking the best of the best from a very deep bench of dozens of different strategies.

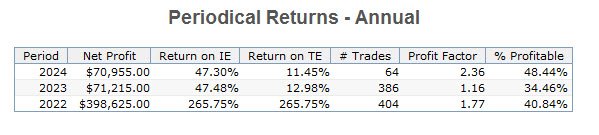

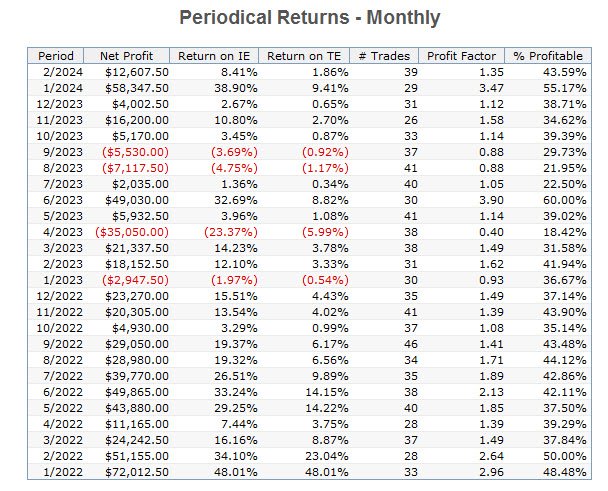

Current Performance covers 1/3/2022 through 2-29-2024

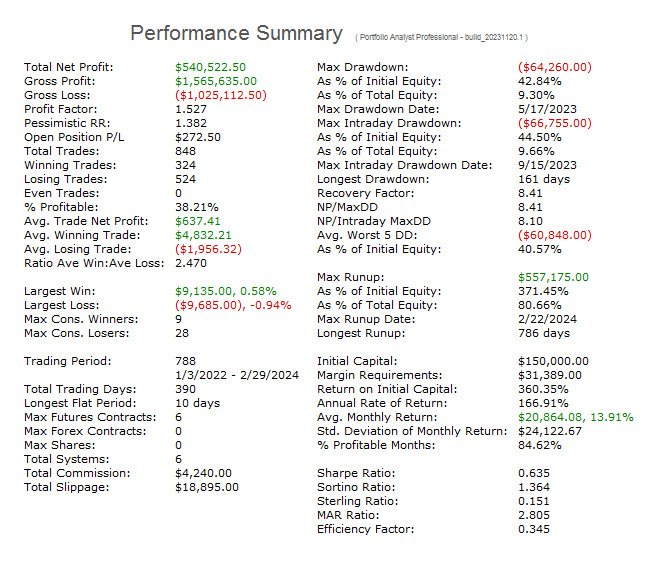

Key Statistics -

Net PL: $540,522

Max DD: $64,260

PL / DD 8.4

ARR: 166.9%

Ave Trade: $637

# Trades: 848

% Profit: 36.2%

Capital: $150,000

Capital Micro: $15,000

This is hypothetical performance.

Government Required Disclaimer - Commodity Futures Trading Commission states:

Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made

that any account will or is likely to achieve profits or losses similar to those discussed in this document. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.